A New Solution to Improve Your Credit Score

Ready to take control of your credit? Our Credit Builder Loan is designed to help you build or rebuild your credit history while enjoying the benefits of financial stability.

What is a Credit Builder Loan?

A Credit Builder Loan is a financial tool designed to assist individuals in establishing or improving their creditworthiness. Unlike traditional loans, the funds are secured in a Credit Builder Savings account that we establish for you. As you make timely payments, you build a positive credit history, leading to an enhanced credit score over time.

If you don't have existing savings, we'll put the loan proceeds in your Credit builder share account and make automatic transfers of payments from your Credit Builder Share for the duration of your loan. The borrower will be responsible for a set amount of initial monthly payments that will be disclosed prior to signing documents.

Example

Loan Amount: $5,000

Term: 60 months

Rate: 3.00%

Monthly Payment: $89.85

How It Works

The borrower will make the first four payments, after which the Credit Builder Share will make the 56 remaining payments.

*In some cases, it may be less or more than 4 payments, but we will review that on an individual basis with the borrower.

Is a Credit Builder Loan Right for You?

Individuals with Limited Credit History

If you're just starting your credit journey or have a limited credit history, a Credit Builder Loan is an excellent option to establish and strengthen your credit profile.

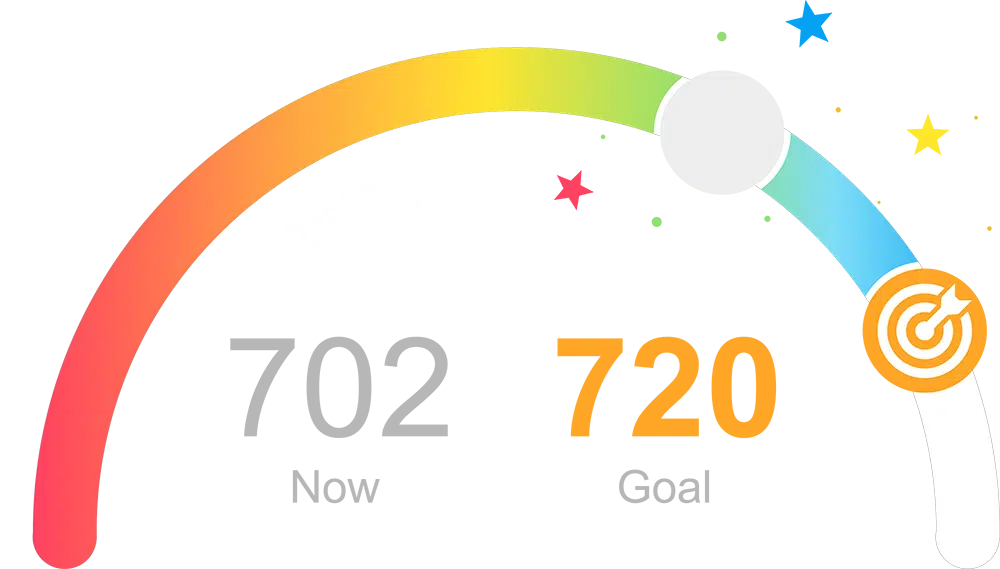

Those Rebuilding Credit

If your credit score has suffered due to past financial challenges, a Credit Builder Loan provides an opportunity to demonstrate responsible financial behavior and gradually improve your creditworthiness.

Young Adults

Young individuals who have yet to establish credit can benefit from a Credit Builder Loan as a stepping stone toward financial independence.

Why Have a Higher Credit Score?

Lower Interest Rates: A high credit score often translates to lower interest rates on loans and credit cards, saving you money in the long run.

Easier Loan Approval: Lenders are more likely to approve loan applications from individuals with a high credit score, expanding your financial options.

Better Insurance Rates: A strong credit score may lead to lower insurance premiums, reducing your overall cost of living.

Increased Financial Confidence: Achieving and maintaining a high credit score provides a sense of financial security and confidence in managing your finances effectively.

Access to Premium Credit Cards and Services: A high credit score opens doors to premium credit card offers and financial services, providing additional perks and rewards.

Why Choose

Tidemark Federal Credit Union?